Charlotte companies have shown progress in opening their boards to women in the last 10 years. But, as is the case nationally, that progress has been steady — and slow.

Duke Energy Corp. (NYSE: DUK) is among the leaders among corporations here. It has gone from one woman director in 2012 to five now. No small part of that strong showing is due to very recent appointments. From March 2021 to March 2022, Duke added five new board members. Two were women, two were Black men and one was a white man.

Duke is a good example of both the progress being made and the challenges public companies face. There were several skeptical questions from Duke shareholders about the size and makeup of its board at the annual meeting in May.

“Please assure investors that directors are selected by best qualification, skills and experience,” an unnamed shareholder asked Chairman and CEO Lynn Good. “The directors should not be a social experiment. Investors invest because they are looking for return on their money.”

Good’s answer may help explain why the progress continues, despite resistance in some quarters.

“We do recruit for skills, whether financial or operational, regulatory, environmental, governance, a wide variety of skills, and you can actually find information around the skills of each of our directors,” she responded. “But I would also say we care deeply about diversity.

“We care deeply about diversity on our board. We care deeply about diversity within our workforce because we believe a diverse group of people — diverse in thought, diverse in background, diverse in gender and ethnicity — helps us solve the complex issues that we face,” she continued.

“And so, we will continue to place a priority on making sure we have the right skills, but we’re also keeping an eye on diversity,” she concluded. “And at this point Duke’s board is 50% diverse on gender and ethnicity, which I am also particularly proud of.”

Included in that diversity is 35.7% female representation among the directors. That is better than the average for the Charlotte region’s 32 public companies with revenue of $100 million or more, according to Charlotte Business Journal research. Those calculations show that, of the total directors on those boards, 28.7% are women.

That regional average appears to be better than the national score. Deloitte has tracked the number of women on boards for seven years. For 2021, Deloitte found 23.9% of all corporate directors in the U.S. are women.

It may be higher for 2022, but not by much, says Dan Konigsburg, Deloitte’s Global Corporate Governance Leader. He describes the annual growth of women on boards in the United States as “sclerotic.”

So, doing well against the national average may not mean much. The U.S. ranks 19th of the 72 countries Deloitte Global evaluated for its latest Women in the Boardroom report, published in January.

The top four countries ranked by percentage of women on corporate boards (France, 43.2%; Norway, 42.4%; Italy, 36.6%; and Belgium, 34.9%) have some form of national quota requirements for publicly listed companies.

Such quotas, Konigsburg says, are among the most effective steps countries can take to increase female representation on corporate boards, according to Deloitte’s analysis.

“Some countries are speeding ahead, but the U.S., which relies on voluntary approaches, is not a market that really wants or appreciates a ‘finger on the scale’ in the sense of a quota,” he says. “Progress has been glacial. It is slow, but it is progress.”

Which Charlotte companies have the most women on their boards?

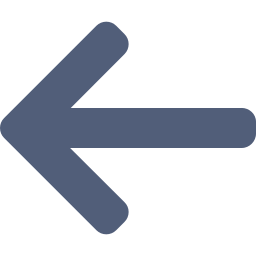

The last three years have shown the greatest average annual growth. But during that period, the average increase was just above 2 percentage points a year, growing to that 23.9% in 2021 from 17.6% in 2018.

CBJ figures should be examined against that national backdrop. In our region, the top companies — at 44.4% women on their boards — are Brighthouse Financial Inc. (NASDAQ: BHF), a relative newcomer to the region, and SPX Corp. (NYSE: SPXC), based in Charlotte much longer but substantially remade in 2015 when it and SPX Flow Inc. (NYSE: FLOW) spun out of the legacy SPX Corp. Honeywell International Inc. (NYSE: HON) and Krispy Kreme Inc. (NASDAQ: DNUT), again recent additions to the region, hold the next two places at 40% and 38.55%, respectively.

Jeld-Wen Holding Inc. (NYSE: JELD), which moved to Charlotte in 2015, and Nucor Corp. (NYSE: NUE), headquartered here since 1966, are tied at fifth, with 37.5% women directors on their corporate boards.

Laurette Koellner is one of three women on Nucor’s eight-member board. There was already one woman director at Nucor when Koellner was recruited in 2015, and there were other companies recruiting her at the time.

She says Nucor was an easy choice, not because it had already showed it was open to recruiting women board members, but for its corporate culture and Nucor’s focus on maintaining and improving it.

She was also impressed with the prime place given workplace safety, which she says is the first topic at every meeting of the board. And she was attracted to Nucor’s emphasis on succession planning.

“Selecting the CEO is one of the main responsibilities of board members,” she says, adding Nucor has been determined to give its board strong candidates from inside the company.

The former Boeing Co. (NYSE: BA) executive took her first board seat in 2001 at Sara Lee Corp. (NYSE: SLE) She serves now on four boards, so she has seen up close a lot of change in the corporate approach to women board members.

“It is very different. I know we don’t see the numbers that we love to see right now, but there are a lot more women in the boardrooms,” she says. “We should be at 50%. We should reflect the population. And we’re clearly not there yet. But I do see genuine efforts and successes taking place among the various boards.”

She sees several reasons for that. There is a move nationally in the environment, social and governance movement to promote greater diversity.

Women are making it into the nation’s C-suites in greater numbers at time when corporations started looking beyond the traditional current and former CEOs who had been the principal board candidates for years. Seeking financial, legal and operational expertise, they began looking at a broader array of top corporate officers.

Companies also are recognizing valuable talents that are not in the traditional corporate realm. She cites Nucor’s recent addition of its third woman board member.

Why is it important for a company to have women on the board of directors?

In 2019, Koellner and her fellow board members selected retired U.S. Army Lieutenant General Nadja West, who had been the surgeon general for the Army, as a director. Koellner thinks it was a great decision, although it did not follow the standard playbook for finding new directors.

Koellner describes how the search often starts with the completion of a standard corporate “skills matrix” on which you “check all the boxes and determine what skills your board is missing.” Then you go out looking for someone who fills those boxes for you, she says. “It’s just a starting point, but it gives you perhaps a slate of ideal candidates for a job.”

Those skills tend to include things like executive experience, participation on other boards and demonstrations of corporate acumen and expertise.

“We were not searching for a retired surgeon general, right? And we weren’t searching for retired general at all,” Koellner says. “However, she exudes leadership. She certainly knows about managing complex organizations. She certainly knows about managing logistics. She knows about leading people. I think if you were on a board that was sticking to that matrix, you might not have been open enough to consider this candidate, and you would lose an excellent board member.”

She thinks corporations are opening up to more women and other underrepresented people on their boards now because it is good for business.

“What I do have a sense of is the more diversity you have on the board the better decisions are made,” she says. “And so, diversity, including gender and the other measures of diversity, just yields better results because you hear a different view, and you respect that view.”

What factors help drive progress in adding more women to boards?

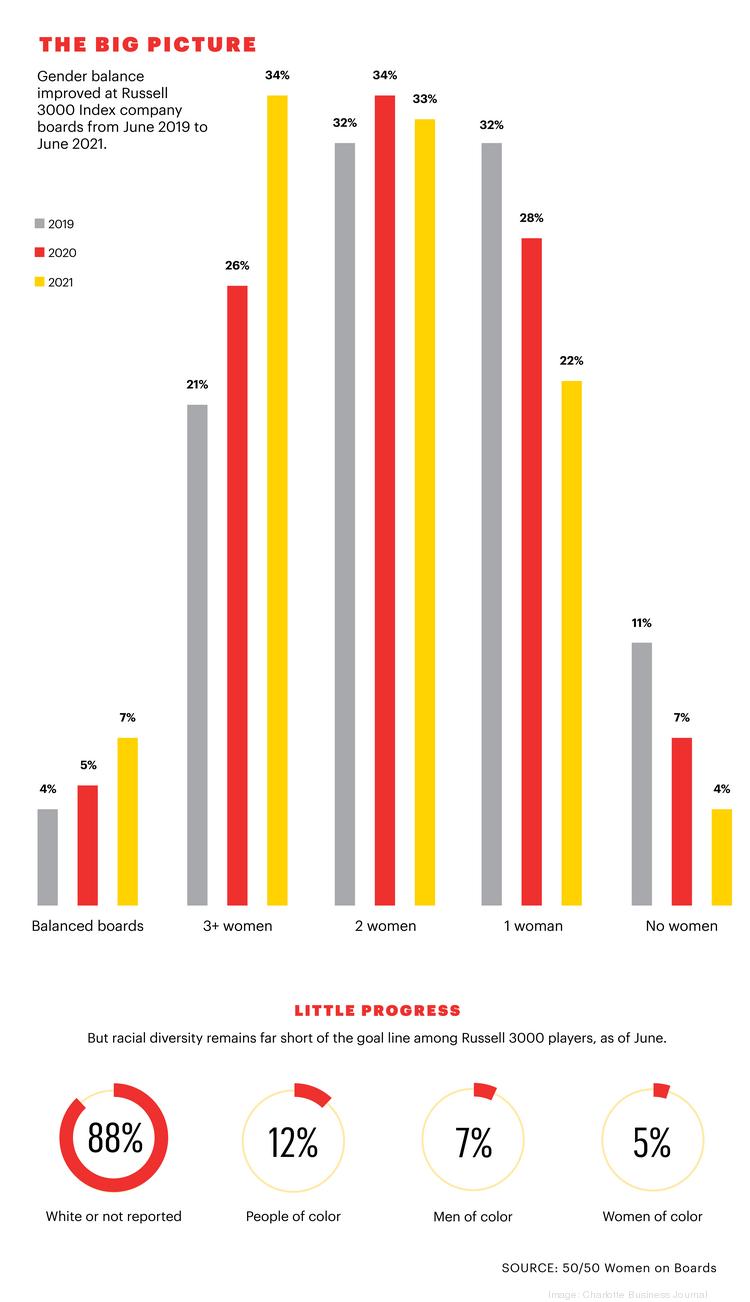

To look at the kind of progress corporations here have made over 10 years adding women to boards, CBJ tracked the number of women at the four largest Charlotte-area companies that were here over that period.

Lowe’s Cos. Inc. (NYSE: LOW), Bank of America Corp. (NYSE: BAC), Nucor and Duke have all made significant progress in those 10 years and are leaders in the region. Deloitte ranks consumer businesses, manufacturing and financial services among the top five public company categories for women on their boards in the United States, so the good marks for Lowe’s, Nucor and Bank of America are in line with national trends.

Duke has shown the most progress over that period — starting with one woman on the board and ending with five.

The 10 years tracked overlaps almost precisely with Good’s tenure as CEO and eventually chairman at Duke. Gwen Young, chief operating officer at the Women’s Business Collaborative, says her group’s research would indicate that is a key factor in Duke’s progress.

The collaborative is a leading advocate of a 50-50 gender balance on boards. And its most recent report “Women Leading Boards,” issued last month, shows companies with women CEOs consistently have more women on their boards than companies with men in the CEO position. Basing its data on the broad Russell 3000 index, the collaborative reports women make up 39% of directors for companies with female CEOs while the average is 26% women on boards at companies with male CEOs.

Deloitte finds the same clear trend, but Konigsburg says it goes both ways. Companies with women CEOs are more likely to have a higher percentage of women directors, and companies with high numbers of women directors are more likely to have a woman CEO. But he says Deloitte cannot determine which causes which.

Young says her group’s analysis sees clear causation. Using both statistical data and surveys, she says the collaborative sees the direction well-established.

And when there is a woman chair, the impact is even clearer that women in the top positions lead to more women on boards, not the other way around.

“The answer is in the research and … it’s not a chicken-and-egg issue,” she says. “It’s definitely the woman board chair. That makes a difference.”

In fact, she cites Duke as an example where that has made an important difference.

But she also notes women CEOs and board chairs are still relatively rare. And while the numbers are improving, the change is not coming as quickly as advocates such as Young would like to see.

Young does not think the current U.S. policy that involves board transparency and reports detailing diversity and progress toward it are sufficient to speed the transition to more equality.

Public pressure, she says, has proven insufficient to produce rapid change.

“It won’t work until you force a company to actually … have a consequence (for lacking female representation),” Young says. “If they don’t have one, they’re going to write off public opinion or they’re going shift focus to be worried about some other kind of public opinion.”